I’m a numbers guy, not a marketing guy. But even the most green-shaded numbers people need to have some understanding of marketing. Generating leads in a niche market is a great way to build a business.

Do you want to break free from the old economy?

How a barber (or any service provider) can avoid the boring parts of running a business

W9 and 1099: Two Tax Forms Every US Entrepreneur Needs to Know About

In my last post I described the benefit of hiring contractors while bootstrapping a startup. I also explained the tax obligation that goes along with hiring contractors, which is to file a 1099-MISC form for contractors that meet certain requirements. I also mentioned severe penalties for not meeting this requirement. In this post, go into more detail about who to issue 1099-MISC forms to, how to file, and what the W9 form has to do with it.

Who do I send a 1099-MISC to (and what does the W9 form have to do with it)?

There’s a long list of requirements for who businesses have to send 1099-MISC forms to, and I encourage you to familiar with the rules so you know what applies to your business. This post is focused on contractors.

You must provide a 1099-MISC form to contractors if they meet the following criteria:

- they provided a service, not a product

- you paid them at least $600

- their business is not classified a corporation (C-Corp, S-Corp, or LLC filing as a C- or S-Corp)

- the corporation rule doesn’t apply to attorneys: you must provide a 1099-MISC form for all attorney fees

- you didn’t pay with a credit or debit card

To find out whether or not the business is a corporation and to get their business address and tax ID number, you should ask the contractor for a W9 form before making your first payment. An electronic copy is fine - you don’t need paper.

The W9 is a simple form that states the business or individual name, tax classification, address, Tax ID. Most contractors should already have the form on file, and if not, they should be able to quickly produce it. Here’s a link to the form.

You don’t need to request a W9 if the business has “Inc” or “Corp” at the end of their name. That tells you they are a corporation.

If a vendor refuses to provide a W9 form, you are required to withhold 28% of your payment and remit to the IRS (or better yet, don’t hire them!). If you don’t issue a 1099-MISC (you can’t without the information from the W9), you could be responsible for that 28% on top of the full payment already made to the contractor.

How do I file a 1099-MISC form and what is the deadline?

Like filing your tax return, there are many ways to file a 1099-MISC. You can mail in paper forms, but I recommend using your accounting software or another online service.

For example, some versions of Quickbooks Desktop and Online allow you to flag vendors as 1099 vendors and save their address and tax ID. At the end of the year it’s very easy to file with information already in the system.

Even if your accounting software doesn’t issue 1099’s, other services may integrate with your accounting software so you don’t have to enter the address and Tax ID, and amount for each vendor. Tax1099.com is a service that integrates with most accounting software.

Other services include Intuit’s standalone 1099 filing service and expressirsforms.com.

These services are very inexpensive (around $3/form) and well worth the cost.

The deadlines are as follows:

Jan 31 (or next business day): provide the 1099-MISC form to contractors

Feb 28: paper file forms with the IRS (not required if electronically filing)

Mar 31: electronically file the forms with the IRS (recommended)

It’s after the end of the year and I didn’t request W9’s. What do I do?

- Run a report in your accounting software to figure out how much you paid each vendor in the previous year.

- Make a list of vendors who you paid more than $600 for services and aren’t obviously a corporation.

- Request a W9 from each one (attach a blank form for convenience)

- See above for filing options

- Start a process now for collecting W9’s from each new contractor!

What if I haven’t filed 1099-MISC’s in the past?

You have some risk of tax liability to the IRS. In an audit the IRS will identify vendors you paid for service. Each vendor you don’t have a W9 on file for and you didn’t send a 1099-MISC forms will have to prove they included your payment in their tax returns.

If they didn’t report your payments or can’t/won’t prove it, the IRS can bill you for 28% of what you paid to the vendor (good luck getting that amount back from the vendor).

If you haven’t filed 1099-MISC’s in the past, start now. Make collecting W9’s a standard part of your process for hiring consultants (don’t make a payment until you get one). Make the filing process easy each year.

Although this requirement is convenient, don’t get on the wrong side of the IRS by neglecting it.

Question: How do you make issuing 1099’s easy each year?

Do you hire contractors? You need to know about the W9 and 1099 tax forms.

Bootstrapping entrepreneurs hire employees only when absolutely necessary. They hire to alleviate significant pain, not because they might need the employee in the future. Building a team of great employees is key to building a successful business. Every leader knows that. However, taking on the cost and commitment of employees too early can hold back and even kill that success.

To lessen the risk of hiring too many, too soon, most entrepreneurs start with contractors. A startup entrepreneur wouldn’t hire a full-time accountant or an in-house lawyer.

Contractors can be anything from a freelancer with a specialized skill, such as a graphic designer, to a large businesses that provides certain services, such as a law firm.

Hiring contractors allows you to avoid many of the costs and complexities of hiring employees. You don’t have to follow labor laws intended for employees, register for payroll accounts with state tax agencies, or pay employer payroll taxes.

However, hiring contractors still comes with tax-related consequences. This post is for a United States audience, but other countries might have similar requirements.

First, you must be careful not to classify someone as a contractor when they should be an employee. The IRS doesn’t like that. They will charge you for the payroll tax you should have paid (plus penalties and interest). But that’s a subject for another post.

In this post, I want to make sure you are aware of another tax risk with contractors.

Did you know that if you don’t handle payments to contractors correctly, you may have to send the IRS 28% of whatever you paid the contractor (on top of what you already paid them)?

The IRS wants their (our) money

Here’s the deal: the IRS has a harder time collecting tax from contractors than employees.

Employees have tax withheld from every paycheck. In most cases these withholdings are more than what the employee owes, which is why most people get a tax refund each year.

The IRS doesn’t have that luxury with contractors, so they came up with a system that increases the likelihood that contractors will report and pay taxes on their income.

What is the 1099-MISC form?

The system revolves around the 1099-MISC form and specifically Box 7 of that form, Non-employee compensation.

You must send to employees and file with the IRS W2 forms after the end of each year. Most business owners don’t need to think much about this because payroll service companies handle it all.

Similarly, you must send to certain contractors and file with the IRS the 1099-MISC form. Usually, this process is a little messier than payroll.

Not every contractor needs a 1099-MISC, and most businesses don’t pay all contractors in the same way. Some might be given checks, some might be paid through the payroll system, and some might be paid by credit card.

Issuing 1099-MISC should be an easy process if properly planned for, and the consequences for not doing so are severe. If the IRS finds that a contractor didn’t report and pay tax on your payments, you will be responsible for 28% of what you paid them (plus penalties and interest) to compensate for the lost tax revenue. Good luck collecting this from your contractor.

In my next post, I will go into more detail about who to issue 1099-MISC forms to, how to file, and what the W9 form has to do with it.

Key Differences Between Canada and US Personal Tax - Payroll Tax

The US-Canada border is one of the friendliest in the world. As a result, many people move back and forth across the border. I am one of those people. I grew up in Canada, went to university and worked in the US, moved back to Canada for a few years, and now live back in the US.

It’s important for people considering moving across the border to understand the difference between the two countries' personal tax systems. Although the principles in each country are similar, the implementation is quite different.

This is the third in a series of posts on the topic.

In my first post I wrote about the differences in tax agencies, impact of moving, filing status, and income tax rates.

In my second post I explained deductions and credits, which can be a confusing concept especially when comparing Canada and the US.

Deductions are credits are one reason income tax rates have little to do with how much income-related tax you actually pay.

In this post, I’ll explain the another reason: payroll tax.

I say "income-related” because payroll tax is not technically income tax, but it is directly related to your income. Income tax and payroll tax are calculated together in both US and Canada tax returns.

Conventional wisdom says taxes are higher in Canada than the US. They must be higher: Canada is more socialized, especially with its universal health care system that residents pay little to nothing for.

This may be true for some situations, but it wasn’t for mine. My income-related taxes went up, mainly because of payroll tax. (On top of taxes, I pay high health care premiums, but that’s another topic.)

Those who move to the US and earn between $50,000 and $120,000 find US payroll tax to be a shocker. In fact, most people earning up to $120,000 will pay much more in payroll tax than income tax.

The payroll tax concept is similar between the two countries. Both contribute to retirement and unemployment programs, and both are mostly split evenly between employees and employers. In both countries self-employed people pay both the employee and employer side.

In Canada, payroll tax consists of:

- Canada Pension Plan (CPP), which pays for retirement benefits (4.95% each up to about $50,000 in earnings)

- Employment insurance (EI), which provides unemployment benefits (up to about $50,000, employees pay 1.88% and employers pay 1.4x the employee rate - 2.63%)

In the US, payroll tax consists of:

- Federal Insurance Contributions Act (FICA), which includes:

- Social security for retirement benefits (6.2% each up to about $120,000 - there’s the big difference)

- Medicare for age 65+ health insurance (1.45% each on all wages with an additional 0.9% from employees only on income over $200,000)

- Federal Unemployment Tax Act (FUTA) (6% up to $7000 earnings paid by employers only)

- State Unemployment Tax Act (SUTA) (rate varies, usually paid by employers only)

ADP provides a simple guide to payroll taxes by state here.

The CRA website has a good guide to all Canada tax rates here.

In both Canada and the US, those who earn income without taxing being withheld must pay quarterly estimated tax quarterly. The deadlines and amounts required are different between the countries. Further, the calculations and requirements can be complicated.

If you are self-employed or for other reasons do not have enough tax withheld to cover the tax you owe for the year, I encourage you to review these rules carefully. Otherwise, you could be hit with significant penalties and interest.

Everyone's situation is different of course. My tax in the US is higher than Canada, but others may find the opposite depending on income level, type of income, and deductions and credits available.

When comparing the two tax systems, don’t forget payroll tax. Income tax rates get all the attention, but payroll tax is the largest factor for most people.

Disclaimer: I am a CPA in both Canada (Chartered Professional Accountant) and the US (Certified Public Accountant), but I am not a tax expert and this post is not meant to be professional advice. My goal is not to write a definitive guide. Rather, my goal is to give you a starting point for your own further research and/or discussions with your tax advisor.

How to Build a Virtual Team

In my last post, I wrote about why you should consider building a virtual team to grow your business. In this post I’ll cover how to actually build a virtual team.

Technology has made building and leading a virtual team easier than ever. Many websites connect available talent with those who can use it, and free or inexpensive tools make virtual collaboration easy.

The following are steps you can work through as you build your virtual team.

1. Decide what kind of team will work for you

There are many different ways to to build a virtual team. Full time or part time. National or international. Specialists or generalists.

If part time, do you want the same people consistently or would you hire for specific projects?

National team members give you the benefit of native language skills and similar time zones. International team members are usually less expensive and can get work done while you sleep.

Of course, your team can be a mix depending on the needs for each role.

You can do some research to help you think through your options.

Chris Drucker is a prominent thought leader around building a business with virtual teams. He wrote a book, Virtual Freedom : How to Work with Virtual Staff to Buy More Time, Become More Productive and Build Your Dream Business, and a weekly New Business Podcast.

Michael Hyatt also writes about building virtual teams, including his book The Virtual Assistant Solution.

2. Find and hire

Once you decide what kind of team member you are looking for, it’s time to find the right person. Many online services can help.

eaHELP specializes in helping you find US-based virtual assistants.

onlinejobs.ph specializes in matching employers to full and part time Filipinos. You can hire full-time, skilled people for $200-$1000 USD per month.

Freelancer sites like Upwork (created by the merger between oDesk and Elance) help you find a variety of skills from all over the world.

Sparehire specializes in high-end finance and consulting projects that range from $50 to $300 per hour.

3. Train and delegate

Once you find the right person, you need to effectively train them to do their job and then delegate tasks to them.

Collaboration software like Slack and project management software like Basecamp make it easy to communicate and assign tasks.

It may be tempting to throw a bunch of tasks at them and expect them to figure it out. However, it may take time to gauge their skill level and how they work best. Expect to spend a lot of time with them up front to make sure they understand your expectations.

4. Lead effectively

Sometimes out of sight means out of mind, but it’s important to remember that these people are part of your team. To help them feel good about doing their best work for you, you need to build a relationship with them just like you would with an on-site team.

Praise them for good work. Find out about their family, interests, and future goals. Acknowledge and celebrate life events, such as birthdays and the birth of children. Let them know how important they are to your team.

Building a business with a virtual team can be cost-effective and give you access to a large talent pool. However, it can take just as much work as an on-site team to find, hire, train, delegate to, and lead your virtual team.

As you invest the time and effort required, your virtual team can help you build a successful business.

Question: How have you gone about building a virtual team?

How do I get started on building a business?

Have you ever avoided doing something because you didn’t know how to get started? It happens to me all the time. For example, I have a goal this year to get involved in some sort of industry organization, but I haven’t done anything yet because I don’t know where to start.

A few years ago I saw the need to bring Dave Ramsey’s Financial Peace University (FPU) to the area I lived in Canada. I had been a huge Dave Ramsey fan for a long time, and he wasn’t well known in Canada. I thought about it for a long time but didn’t know where to start.

It only took a push from a friend and a small amount of research to get started. I found a sponsor, figured out how to order class materials, and did a small trial class with some close friends and family. With that momentum I recruited some volunteers to help, and we ended up taking about 150 families through the course in several sessions over two years.

Usually the hardest part of any endeavor is taking the first step, even if you don’t know where the next steps are going to lead you. As you start stepping, you gain momentum. With that momentum, future obstacles are easier to overcome than resistance to the first step.

In my last post, I asked if you are ready financial, emotionally, and mentally to start a business.

If you are ready, here is where to start:

1. Find a product to sell

2. Find customers to sell the product to

It’s as simple as that. Until you have a product and customers, nothing else matters. You don’t need to worry about bank accounts or bookkeeping or taxes or insurance or legal entities or other details that you might feel anxiety about.

Just get started by figuring out what you are going to sell and who you are going to sell to.

Find a product to sell

A product to sell can take many forms, and there are too many possibilities to list in this post.

If you’re not sure where to start, your product can simply be your time and expertise offered to multiple customers. Examples include bookkeeping, writing, graphic designing, lawn care, and even dog walking.

Selling your time and expertise is a good way to get started, but usually your impact (and therefore income) will be limited by the number of hours in your day. You might see an opportunity to package your expertise into some kind of digital or physical product. You might write an ebook or build an online course.

Find customers to sell to

It might seem logical to first figure out a product and then find customers to sell that product to. However, the reverse can also work.

Building an audience (or platform) is a way to find customers before having a specific product to sell. Through social media and blogging, you can position yourself as an expert in your field. As you generously give free and valuable content, you can build a loyal following.

Email subscribers to your blog are especially valuable. As you find your voice and build your following, you can ask your followers what they need help with. You can create products to meet their needs, and then you’ll have both a product and customers to sell to!

There are many resources to help you build your audience. Michael Hyatt is one of my favorite.

Then worry about the details

You can start thinking about the administrative details that go into running a business once you having paying customers.

This post is targeted to individuals with the entrepreneurial bug who want to strike out on their own. Not all businesses are this simple. Some companies raise investment capital, hire employees, and go through years of product development before taking their first customer payment.

However, the same principles apply. Every business needs to start with a solid product concept to sell and customers to sell to. Until then, nothing else matters.

Question: Business owners, how did you get started with your business?

Is it time to start your own business?

Are you an employee with an entrepreneurial bug? Do you want to have the freedom, fulfillment, thrill, and potential financial rewards of building your own business? If so, how do you know if it’s time to make the leap?

Of course, there is no one size fits all answer, but here are some questions to ask yourself.

Am I financially ready?

Building your own business can give you an almost unlimited financial upside. However, many businesses fail, especially in the early stages. Many business who don’t fail struggle along for a long time without making much money.

It’s important to be financially prepared for a slower start than you expect.

If possible, start to build your business while employed full time (as long as it doesn’t violate employment agreements). Ideally, build your business until it brings in close to as much income as your job. As long as your business is growing and future prospects seem promising, quitting your job to focus on your business will be a no-brainer.

However, this perfect scenario may not be feasible. You will probably find it difficult to replace your full-time income with part-time attention.

I still recommend starting your business while enjoying a steady paycheck. Don’t step off the dock unless a boat is waiting, even if it’s a leaky old boat. Once your business starts generating income and appears to have the potential of exceeding your employment income, it may be time to make the jump. The boat only has to keep you from drowning while you work to improve it.

If you make the jump before the revenue from your business covers all your business and personal expenses, I recommend having savings sufficient to cover the shortfall for at least 6 months and preferably 12 months.

6 to 12 months will give you some cushion as you start growing more aggressively. Without much in savings you may be forced to bail from your business prematurely or give up control to bankers or investors.

Don't use debt to start your business! Using your own savings forces you to use more discipline. And if your business fails, you've only lost some savings. Banks won’t be threatening to take your house.

Am I emotionally ready?

Building a successful business requires a tremendous amount of grit.

I've written before about the emotional roller coaster most business owners go through. I’ve also written about the importance of resilience.

Are you emotionally prepared to handle the daily ups and downs? Can you stay the course without giving up when you experience a serious setback? Can you push through periods of self-doubt when you wonder if you have what it takes?

Running a business can be incredibly rewarding, but it will probably take some emotional pain to get there.

Am I mentally ready?

Starting a business requires tremendous self discipline and focus.

Most employees are forced to have discipline to some extent. Some are expected to show up to work at a certain time and stay until a given time. Most are given rather than choosing certain responsibilities. Some have performance reviews and a structured path to promotions.

Business owners have none of this forced discipline. You must create your own discipline.

Of course, you must serve your customers (or you won’t have any). But in most cases your customers won’t know or care what time you show up for work. The freedom to choose the hours you work is wonderful, but building a successful business usually means working many more hours than an employee.

Are you ready?

It’s important to be as ready as possible, but no one is perfectly ready, and there is no perfect timing. You will always have doubts and worries, and the earlier you can be prepared to start, the better.

If you spend another 10 years wondering if you should do it, you’ll wish you had spent the last 10 years building your business.

If you think you can handle the financial, emotional, and mental demands of starting a business, go for it!

Question: Business owners, how did you know when it was time to start your business?

4 Ways to Automate Your Accounting

I try to use systems in all areas of my life. Systems automate routine tasks that lead to important outcomes. Systems maximize consistency and minimize time and energy. Systems allow us to focus more on the outcome than the routine tasks that get us there. In business, these systems can take the form of processes. Accounting is a business function particularly conducive to structured processes. The value in accounting comes with the ability to analyze timely and accurate numbers that your processes generate and not in the processes themselves.

Of course, all large business have complex accounting software and processes to make sure their transactions are recorded accurately and their financial statements prepared timely.

I will focus on on 4 ways freelancers and small business owners can automate their accounting:

1. Use checklists

The less you have to think about routine tasks, the more brainpower is freed up for more important activities. Checklists are a great way to minimize the thinking required.

Checklists can be used for any repetitive task, which includes most of the activities a business engages in. Examples include:

- Onboarding a new employee

- Setting up a new vendor

- Setting up a new customer

- Closing the store or restaurant at night

- Preparing an order for shipment

Checklists are especially helpful in nailing the month-end end accounting close, which brings me to my next point…

2. Nail your month-end close

"Month-end close” or the “financial statement close process” might sound like a complicated activity that only big companies worry about, but it simply refers to the activities that provide accurate financials after the end of a month.

The sooner you can get financial statements after the end of the month, and the more accurate those financials are, the better decisions you will be able to make.

This process should be so well defined and refined that it’s automatic. It doesn’t mean smart and skilled people aren’t required to carry out the system, but it means these people don’t have to figure out the process every month. Instead, they can use their valuable time and brainpower to analyze the financials and identify areas for improving the business.

Checklists in a Google Sheet have worked well for me. A tab lists all the tasks required to close out month end, when each task needs to be done, and who is responsible for each. Those responsible sign off on each task, giving me a real-time status.

Setting up bank feeds helps to automate month end. Most accounting software packages, such as Xero and Quickbooks Online, connect directly to bank accounts and credit cards and download new transactions every day. Bookkeepers only have to assign the correct account code to each transaction before reconciling the account.

Software that doesn’t support bank feeds should at least support transaction import, which allows you to download the transactions from your bank account and import the downloaded file into your accounting software.

3. Use dashboards and scheduled reports

It’s good to review a full set of financial statements monthly, but you’ll often need information sooner to make decisions. While it’s not practical to perform the full accounting process more than monthly, important transactions such as sales should be recorded in real time.

As a business owner, you should have access to as much real-time information as possible. Some accounting software will email you reports on a set schedule. For example, for one company I get a daily automated email with customer payments received, new orders received, and orders shipped. This allows me to keep a daily pulse on the business.

4. Outsource your bookkeeping

It doesn’t make sense for many freelancers and small businesses to hire full-time bookkeepers. In some small businesses, employees wear multiple hats, and the office manager, for example, may double as a bookkeeper. This may work out okay if you have team members with sufficient time and are comfortable with bookkeeping.

However, in most cases it’s better to outsource your bookkeeping. This allows you to hire for specific skills needed to add value to your business. You can outsource to accounting firms, but this is often quite expensive. I recommend finding offshore bookkeepers though a service like Elance.

All of the companies I work with have used offshore bookkeepers for several years, and it works great. We pay between $6 and $12 per hour, depending on the complexity, and the bookkeepers are accurate and dependable. For example, we forward any invoices we receive, and they do the accounting software entry and file the digital copy. They also complete most of the month-end checklist.

Automate Your Business

Accounting is an obvious candidate for automation, but you can automate any area of your business. It can help to recognize anything that is done on a regular basis and think about how it can be automated.

Question: What other tips do you have for automating accounting?

What Kind of LLC Should I Set Up?

When running a business, the type of legal entity you choose is a complex and important decision. I recently had to research what type of LLC to set up for a married solo practitioner, or freelancer. I thought I would write about what I have learned to help my thought process and to hopefully help someone else facing a similar decision.

If this post doesn’t apply to you or anyone you advise, you can check out some of my past posts that might be more relevant by using the topic buttons (computer) or menu (mobile device) above.

LLC vs. Sole Proprietorship

Freelancers who have a full-time job but pick up work on the side will probably start out operating as a sole proprietorship. In fact, you don’t have to do anything but earn extra income to operate as a sole proprietorship. The income becomes part of your business activities, which you report on Schedule C of your personal tax return.

The benefit is that setting it up doesn’t require anything more than any licenses and permits required to operate the business, which probably doesn’t apply to most freelance work.

The down side is there is no legal separation between you and your business, which makes you personally liable for debts, lawsuits, and actions of employees. This puts your personal assets at risk.

An LLC is a legal entity separate from its owners, or members, so the owners aren’t personally liable for the business (with some exceptions). LLC’s are easy and inexpensive to set up and maintain. The filing fee for the LLC I set up in Utah was $70. The only maintenance needs are tax and regulatory requirements, which you’d have to do for a sole proprietorship anyway, and a $15 annual renewal fee.

If your business is anything more than small side jobs here and there, it is usually wise to set up an LLC. Search online for “how to set up an LLC in [your state]” and you’ll find many resources with step-by-step instructions. For example, see here for Utah instructions.

Types of LLCs

Once you’ve decided to set up an LLC, you’ll have to decide how it’s structured for tax purposes. There are several variations, and each state may differ slightly, but the following are 3 types of LLCs I considered:

1. Single-member LLC (Disregarded entity) As indicated by the name, a single-member LLC is owned by one person. The owner can either file Form 1040 Schedule C like a sole proprietor (become a disregarded entity) or elect to be taxed as a corporation.

There are some disadvantages when compared to a multi-member LLC, including: - Some risk of losing the LLC personal liability protection benefit in the event of a lawsuit or audit. Courts may not recognize the person as being separate from the entity. - Possible increased risk of an IRS audit because sole proprietorships are audited more frequently than partnerships or corporations.

This article talks about these and other disadvantages.

One advantage of a single-member LLC is that it qualifies for a Health Reimbursement Arrangement (HRA) if one spouse is the owner and the other spouse is an employee. This is a program administered by a 3rd party that allows your LLC to reimburse 100% of out-of-pocket health expenses and individual health insurance premiums. The HRA is the only way I’m aware of to make individual health insurance premiums fully tax deductible. Multi-member LLC’s do not quality for an HRA.

You can read more about HRAs here.

2. Multi-member LLC (Partnership) Multi-member LLCs, obviously, are owned by more than one person and can be elected to be taxed like a partnership or a corporation. As a partnership, the LLC must file Form 1065 and provide each member with a Schedule K-1 showing their share of the LLC income, credits and deductions.

A multi-member LLC overcomes the disadvantages of a single-member LLC described above. Married couples can create a multi-member LLC by each owning a share of the company.

LLC members active in the business must pay self-employment tax on their entire share of the profits. Married couples are always both considered active members, even if one is not active in the business. The maximum earnings limit ($118,500 in 2014) applies to each spouse. If the profits are more than the maximum, and if you want to minimize this tax, you might want to assign one spouse a very small percentage.

This article goes into detail about single-member vs. multi-member LLC’s for married people.

3. LLC as an S-Corp An LLC can elected to be treated like an S Corp. This is an interesting way to minimize self-employment tax. The members don’t have to pay self-employment tax on their share of the profits, but active members (again, both spouses) must be paid reasonable compensation subject to self-employment tax.

This article talks about electing S Corp status, and here is an IRS publication that describes “reasonable” compensation.

Summary

There is much more to choosing a business entity than I have covered here, but hopefully my research on LLC’s helps familiarize yourself with the options available. Understanding the basics will allow you feel more confident in working with a professional advisor to make a final decision.

Note: I am not an attorney, and although I’m a CPA, I am not a tax accountant, so don’t take this as professional advice. I have provided this material for informational purposes only, and I encourage you to seek competent tax and legal counsel.

5 Ways to Learn a New Industry

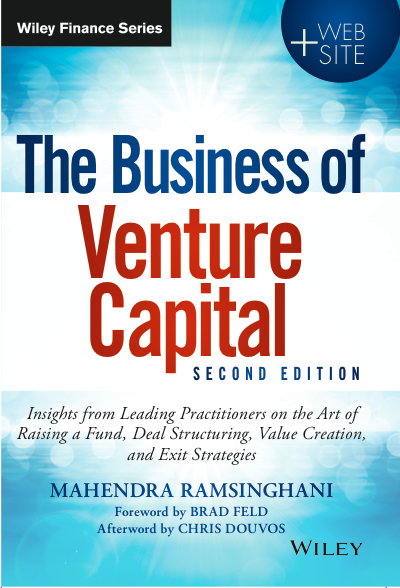

I work with a venture capital fund and several startups, and I have had to learn a completely new industry with every new project. I am involved with building materials, telecommunications infrastructure, clean energy, and mattresses, to name a few. Lately I have been working especially hard at learning the venture capital industry. As part of this effort, I am in the process of reading The Business of Venture Capital by Mahendra Ramsinghani. It is an excellent, comprehensive look at all aspects of venture capital. This got me thinking about the approach I have taken to learning a new industry as quickly as possible.

Many people spend a lifetime learning a particular industry. However, it’s common to change career direction many times. While nothing can replace many years of hands-on experience, it’s possible to accelerate the learning process.

Here are some tips and tricks for scaling the learning curve in a new industry:

1. Read books Books are a powerful way to acquire new knowledge and insert yourself into new experiences. Of course, reading is not a perfect substitute for actually being there, but being there takes time, opportunity, and luck.

In a previous post I talk about my experience listening via audio book to 4 incredible stories about the founding or turnaround of Twitter, Facebook, Blackstone Capital, and Ford. For $44 and two weeks while doing things I had to do anyway, I experienced 50 years of building or turning around 4 multi-billion-dollar companies.

2. Follow trade publications Every industry has trade publications, and they are great ways to learn and stay current on new developments.

The mattress industry was new to me, and I work with industry veterans with 20-30 years of experience. Even though I can’t match their years of experience, I have become familiar with the industry by regularly reading the two main trade publications, Furniture Today and Bedtimes.

3. Attend conferences and trade shows Gatherings like this can be challenging to navigate, especially for an introvert like me. But every industry has conferences and trade show where the who’s who of the industry gather in one place. At these events you can learn from speakers, panel discussions, and product/service booths.

Building your network of contacts is just as important as learning an industry, and conferences are an efficient way to build your network.

Attending the semi-annual Las Vegas Market for the home products industry has accelerated my industry knowledge and contacts.

4. Participate in networking events Most industries have local get-togethers for networking and learning.

I recently attended a networking event in Salt Lake City that I found very valuable. It was organized and attended by professionals in similar industries and career stage. The organizers invited a high-profile speaker a few years ahead of us in experience and success. We were able to build our contacts with each other and learn from the speaker's experience.

You can find networking events through Internet searches or LinkedIn, for example. If you can’t find relevant networking events, organize one yourself! There’s no better way to get to know people and build credibility in an industry than to be a leader.

5. Visit the front lines It’s great to gain experience in the board room or in executive meetings, but the real work happens on the front lines: stores, call centers, factories, etc. It’s impossible to understand an industry without understanding the front lines.

When I first became the CFO of a building products manufacturer, I spent a lot of time working alongside the production team in the factory. This was challenging, but it was the fastest way to learn the processes and get to know the team. Being on the floor gave me the understanding I needed to made process improvements that cut labor costs in half.

The speaker at the Salt Lake City networking event I mentioned talked about the turnaround he led of a local company. I was with a colleague, and we happened to be driving by this business on the way to our next meeting. We stopped in and talked to one of the front-line employees who was there during the turnaround a few years ago.

We learned a lot as he told us about his experience, including the methods used to drive the turnaround. It was most instructive to hear the gratitude and respect in this employee’s voice as he spoke of that experience.

Go and learn! There’s no reason to be afraid of learning a new industry. Of course, it’s difficult to replace years of experience in a short amount of time, but you can use these tips and tricks to dive into a new industry and become a veteran in a short time.

Question: What approach have you taken to learning a new industry?

3 Ways to Transition from Freelancer to Business Owner

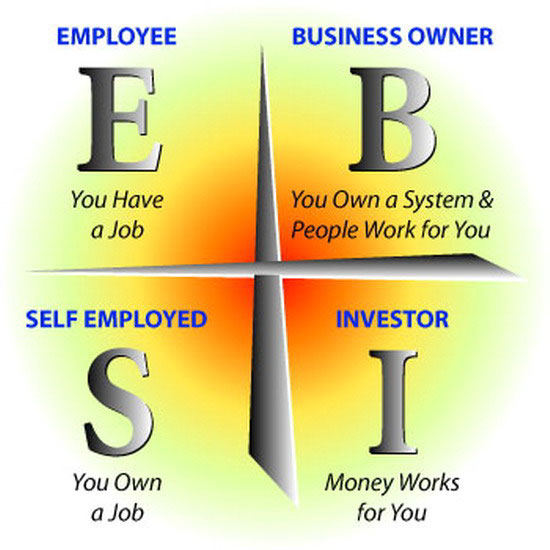

Robert Kiyosaki is the author of Rich Dad, Poor Dad, and his CASHFLOW Quadrant has shaped my way of thinking about how to make money. As shown in the image below, he describes four ways to make money: Employee, Self Employed, Business Owner, and Investor. He argues that those on the left side of the quadrant can never build true wealth in part because they are trading a finite resource, their time, for money.

I wrote a series of posts a while ago about freelancing, which is in the Self Employed quadrant. Compared to being a traditional employee, freelancing can have advantages like accelerated career development, increased income, diversification, and autonomy.

However, freelancing is still trading time for money. The benefits of freelancing are amplified for those who successfully transition to Business Owner on the right side of the quadrant. As a business owner you can multiply your income without increasing the amount of time you spend earning it.

Here are 3 ways to transition from freelancer to business owner:

1. Dedicate a portion of your time to work for yourself

Hire yourself as one of your freelance clients, and give yourself the responsibility of building a business.

I recently heard Gary Vaynerchuck give the following the advice (paraphrased): live on as little as possible and spend the rest of your money investing in yourself.

This is a variation on that theme. Trade the minimal amount of time for the money you need to live on, and then spend the rest of your time building your business until it can replace your freelancing income.

At first your time might be spent on figuring out what kind of business to build. As you begin building a business, you might need to do a little more freelancing to finance the business.

Grow slowly. Don’t take on debt to grow your business! This works for some people, but debt creates risk and kills many of the advantages of being a business owner. Instead of additional freedom and income, you will become a slave to your business, your creditors, and interest payments.

2. Look for ways to automate your expertise

When Dave Ramsey began his mission to educate the world about personal finance, he did one-on-one financial counseling. It didn’t take him long to realize that he couldn’t build a successful business this way. Growth was limited to the amount of time he had for clients, and the very people who needed help the most weren’t able to pay enough to make the business viable.

Instead, he wrote a book to automate his expertise. The only limit to the number of people he could help is how many were willing to spend $10-20 on his book. He started a radio show where he could share his expertise with many listeners at the same time. He wrote more books and developed training courses. Now he is the multimillionaire owner of a 450-employee business that helps millions of people around the world.

Many freelancing skills can be automated in a similar way. Freelance writers can write books or syndicated columns. Freelance programmers can write online software that people are willing to pay a subscription to use.

3. Hire people to leverage your time

A freelancer working alone must do everything from high-value client presentations to low-value expense report preparation. Freelancers can leverage their time by hiring help for lower-value tasks. The booming virtual assistant industry makes this cheaper and easier than ever before.

Some of the companies I work with don’t have enough transaction volume to justify hiring a bookkeeper, but they also don’t want to pay me to do bookkeeping. Instead, I turned to Elance. I found an accounting firm based in India that charges $6-8/hour, depending on the task. They handle all data entry and month-end procedures. I simply spend a minimal amount of time reviewing the financials for accuracy, and then I’m free to perform high-value tasks such as presenting to the management team insights gleaned from the financials.

It helps to look at everything you spend your time on and ask if there’s someone else than can do this almost as good as me for much cheaper. If you are paid $75/hr as a freelancer, why not spend $5-20/hr for virtual assistants to take tasks off your plate? Good candidates include travel arrangements, preparing expense reports, gathering content for social media posts, doing market research, preparing PowerPoint presentations, etc.

As you grow, you can even hire good people for the high-value tasks. As the business owner, you can earn money while you sleep or vacation.

Conclusion

Moving from Employee to a Self Employed freelancer is a step in the right direction. However, I encourage you to see if you can use these 3 methods to make the leap to Business Owner on the right side of the CASHFLOW Quadrant. Then you can enjoy the benefits of multiplying your income without multiplying the time you spend working.

Question: What are other ways to move from freelancer to business owner?

How to Get Started as a Freelancer

I've written a lot about freelancing lately. As I’ve described, I’m excited about this work model because of the benefits I’ve seen for me and my clients. The freelancing model doesn’t work for everyone in every situation, but I think it’s important to be aware of alternatives to the traditional employer-employee relationship.

In this post I will provide some ideas for getting started as a freelancer.

Develop deep expertise. Companies look for freelancers who have deep expertise in a particular area. Often companies use existing staff to cover general needs and hire additional generalists as they grow. Many companies, especially small ones, aren’t willing or able to hire full-time employees to fill specialized needs.

This is why the freelancing model works well for CFO’s, marketing executives, HR specialists, writers, videographers, and programmers, to give a few examples.

Gain broad experience. Aspiring freelancers should develop deep expertise, but they should also take opportunities to broaden their experience. The more a freelancer understands all areas of business, the more valuable they will be in their specialized area. It also helps to gain experience in different industries, in different locations, and with different teams.

For example, a freelance CFO may be expected to set up processes in all areas of the business from sales to order processing to shipping to bank reconciliations. A CFO is also expected to interpret data and provide strategic insight into all areas of the business.

Network. Freelancers depend on relationships and word of mouth for opportunities. Like any hire, companies take a risk by bringing on a freelancer. On-boarding takes time, and the quality of work reflects on the company.

For this reason, companies want to work with who they know or those known by who they trust. Not many freelancers get hired from a cold call.

Be a superstar. Because freelancers depend on word of mouth for opportunities, their work needs to be something worth talking about. Many successful freelancers first gain a reputation as a full-time employee for being the hardest worker and the go-person for solving problems.

Start slowly. Full-time employees shouldn’t jump ship and then go looking for clients. Look for opportunities to gradually transition a full-time role to a part-time role as new opportunities come up. Without being unfair or dishonest to your employer, take opportunities do take on freelance roles outside of regular work hours.

As I described in a previous post, my freelance career began when I had the opportunity to cut my full-time role to half time when another half-time opportunity came up.

Freelancing is a fast-growing segment of the economy. In some cases it can provide greater benefits to the freelancer and the client than a traditional full-time arrangement. Hopefully these tips help those considering making the transition to freelancer.

Question: How did you get started as a freelancer?

Links to past freelancing posts: Here I describe how I discovered the benefits of being and using a contract CFO. Here I dig a little deeper into why companies should consider a contract CFO. Here I more broadly discuss the pros and cons of freelancing. Here I look at skills and attributes freelancers should develop.

6 Skills and Attributes Freelancers Should Develop

In a recent post I described how I discovered the benefits of being and using a contract CFO. My next post dug a little deeper into why companies should consider a contract CFO. In my last post I more broadly discussed the pros and cons of freelancing. In this post I will continue that theme and look at six skills and attributes freelancers should develop. I approach this from the perspective of a contract CFO, but most skills apply to all freelancers.

1. Organized. Effective time and information management is critical. Freelancers have to keep up on what is going on with several different companies possibly in completely different industries. Clients will expect you to be up to speed and on top of responsibilities just as if you were a full-time employee. I use tools like Evernote and Remember the Milk to keep track of everything.

2. Problem solver. This sounds cliche, but the ability to quickly solve a wide range of problems is a major factor that separates a valuable advisor from a clerk. For example, contract CFOs need to be the expert on financial matters. They need to know how to account for that complicated transaction. They need to know to interpret the data. There's no one else to ask.

3. Quick learner. This is related to problem solving, but it is important for freelancers. When they take on a new client they need to very quickly learn the business and industry. The client does not want to pay a freelancer to learn.

4. Tech-savvy. This is true in any field, but tech skills can differentiate a contract CFO. There's a shortage of professionals proficient in both accounting/finance and technology. Technology is inseparable from business process, and in a small company without significant IT resources, a CFO who understands technology is valuable.

Technology has been an integral part of all my roles. I landed one role because, in addition to CFO responsibilities, I was able to lead a software implementation to integrate sales and accounting. With another company I took several separate systems, including bookkeeping in Quickbooks, order tracking in Google Drive, and CRM in Salesforce.com and implemented Netsuite to consolidate all those functions into one system.

5. Confident. Many of us suffer from impostor syndrome, meaning we are convinced that we are frauds and don’t deserve the success we have achieved. It’s easier for companies to get rid of a freelancers than employees, so freelancers need to consistently prove their value. It’s easy for freelancers to fear that their clients at any time will discover they are frauds and let them go. Allowing that fear to motivate rather than debilitate requires confidence.

6. Likable. Competence is not enough; freelancers must also be likable. Companies will only hire freelancers they like, and they will only keep freelancers they continue to like. They might put up with a challenging employee or find an assignment that suits that person better, but they most likely won’t feel that kind of a loyalty to a freelancer.

This list could be much longer, but I think it’s representative of some of the most helpful skills and attributes for freelancers.

Question: What other skills and attributes do you think are important for freelancers?

Pros and Cons of Freelancing

In a recent post I described how I discovered the benefits of being and using a contract CFO. In my last post I dug a little deeper into why companies should consider a contract CFO. In this post I’ll more broadly discuss the pros and cons of freelancing.

I started writing this post as a separate list of pros and cons. However, I realized that pros and cons can be one and the same depending on experience, goals, and personality. Overall, being a freelance CFO has been great for my career and lifestyle. I’ll list the pros from my perspective while also acknowledging that each point could also be a con.

Career development. Freelancers can multiply their experience and contacts by taking on multiple roles at the same time. They can work with different management teams in different industries at different company stages, all at the same time.

At one point I was working in the hospitality, construction materials, furniture, venture capital, and telecommunications industries with companies at pre-revenue, growth, and maturity stages. The companies had many of the same shareholders, but each management team was separate.

Being a freelancer certainly isn’t the only way to get a variety of experience. In a large company, future executives often develop their careers by frequently rotating among different teams and departments. People also tend to change employers often to develop the breadth of their careers.

One down side of multiple roles can be lack of integration within teams. Freelancers can integrate themselves by being as responsive as full-time team members. They may not be able to complete every task immediately, but they can be responsive. I’ve had accountants or law firms take days to respond to my emails, which clearly sends the message that they are outsiders and not integral parts of the team. Freelancers can also make an effort to build strong relationships with individual team members.

Another down side to multiple roles is competing demands. If you prefer to serve one master, being a freelancer may not be for you. There have been times when all of my clients have wanted to schedule a meeting for the same time or have project deadlines close to each other. Sometimes I’m forced to prioritize, and sometimes I have to work long hours to get everything done.

I personally find variety and multiple demands on my time motivating and stimulating, but it’s not for everyone.

Increased Income. Many companies can’t pay market rate for a full-time employee to meet specialized needs, but most can pay a percentage of the market rate. Freelancers can make more than a full-time employee if they find enough clients and charge enough to take into account the costs of being independent. It is good for the company because they won’t have the commitment and fixed cost of hiring a full-time employee.

Freelancers have to remember that their revenue is not equivalent to a take-home salary. They should charge much more than a percentage of market rate based on time to cover costs like both sides of payroll tax, health insurance, travel, laptop, cell phone, and training. They also need to build in time for training, networking, and finding clients.

While a freelancer may generate higher income than a full-time employee, freelancing usually involves trading time for money. It lacks the opportunity for leverage that other businesses might provide, such as selling a physical product or developing software.

Some freelancers have overcome this somewhat by building their services into a practice resembling a traditional accounting or law firm. For example, some contract CFOs offer a full range of business outsourcing services led by the CFO role and hire staff to carry out the lower-level work.

Diversification. Many businesses decline or fail, which gives their executives little job security no matter how valuable they are. If freelancers lose one position, they still have their other clients.

This allows them to take more risk than they might be comfortable with as a full-time employee. I provided services for an undercapitalized, pre-revenue company with a high burn rate and inability to consistently pay my fee. The market potential was huge, but it would take a long time with a high risk of failure. I probably wouldn’t join this company as a full-time employee, but because I had other clients, I was willing take the risk.

Being a freelancer is great middle ground for the entrepreneurial and risk averse. It offers more upside than being a full-time employee, and it doesn’t require start-up capital or risk of loss (as long as you don’t let your clients get behind on paying you).

Autonomy. I don’t like being tied to the same office on the same nine to five schedule every day. I work hard, and I work long hours, but I like to be able to choose what hours I work and where I work from.

I usually work a fairly consistent schedule, but sometimes I keep working until late at night when I’m on a roll and then sleep in the next day. If it’s a nice day I might do something with my family in the afternoon, but I’ll start early and work late to make up for it. And even when I’m not working during regular business hours, I always make sure I’m available by phone or email so my clients don’t know the difference.

I do a lot of work at home and only go to an office when I have a reason to be there. I can be much more focused and productive without a commute and office distractions.

Of course, autonomy can be a challenge for those distracted easily. Even though the office has distractions, at least you’re there for the purpose of working. Home offers many more distractions with no accountability from team members. It takes self-discipline and self-motivation to have a flexible schedule and location.

Conclusion

In general, freelancing can benefit both the company and the freelancer, but freelancing isn't for everyone or for every situation. Hopefully these points help as you consider freelancing.

Question: What are other pros and cons of freelancing?

Why Hire a Contract CFO

In my last post I described how I discovered the benefits of being and using a contract CFO. In this post I’ll dig a little deeper into why companies should consider a contract CFO. The CFO role is perfect for freelancing. All companies need the CFO role, but not many companies need and can afford a full-time CFO. I won’t try to put guidelines around when a company needs a full-time CFO because it depends on size, stage, funding needs, industry, etc.

Many smaller companies struggle at one of two extremes. On one hand, some do without critical CFO-level expertise because they can’t afford an experienced full-time CFO. On the other hand, some companies overpay for CFOs who do CFO-level tasks in some of their time and lower-level tasks for the rest.

Consider the Freelance Model

Let's look a little closer at the part-time or freelance model. What are the services needed to build a company? Product development, engineering, manufacturing process, sales, marketing, HR, accounting, logistics, procurement, and the list goes on.

Companies are accustomed to outsourcing some of the services they need. Only the biggest companies like Walmart have their own fleet of trucks and drivers. Most companies use freight companies to move their product. It's an essential service, but it's not a full-time job for most companies.

Only the biggest tech companies like Google and Facebook build data centers full of their own servers. Even Netflix uses Amazon’s AWS servers. Only the biggest companies have lawyers on staff. The rest use law firms.

If a small company hires a CXO or VP for every area of the business, it will become top-heavy and topple.

Identify Core Skills

It depends on the type of business, but usually product development and sales/marketing are the most critical skills that demand a start-up founding team’s 100% focus. Until it has a viable product and customers to sell it to, there's not a lot for anyone else to do.

The challenge is that businesses need expertise in other areas from the beginning. They need to make sure the business is structured properly and the numbers make sense. For structure, the start-up would hire a law firm, not a full-time lawyer. For the numbers, the start-up can hire a contract CFO.

Find a Contract CFO

There are many solo freelancers and CFO services firms out there. Referrals are always the best way to find people to help, but you can also use LinkedIn, Google, and other online tools.

Many CPA firms offer CFO services, and some of them might be a great option. In my experience, accounting firms are focused on tax and assurance services and typically lack the operating experience and time to be able to effectively provide CFO services.

Hopefully this post opens business leaders' eyes to the possibility of getting financial expertise at an affordable cost.

Question: What benefits have you seen from hiring a contract CFO?

How I Became a Contract CFO

Forbes calls the freelance economy the future of work. They estimate that one in three Americans works as a freelancer and that by 2020 one-half of Americans will freelance. A freelancer can be defined as someone who does work for more than one client as an independent contractor as opposed to an employee of one company.

The CFO role is perfect for freelancing. All companies need the CFO role, but not many companies need and can afford a full-time CFO. I learned about the role and benefits of a contract CFO largely by accident. In this post I’ll describe how I became a contract CFO and then outline the benefits both to the CFO and to the company.

Fresh from University

I began my career with a Big 4 accounting firm in its IT and financial audit departments. I loved the experience and people I worked with, but at the same time I wrestled with the direction I wanted to take my career. Gradually I came to the conclusion that I would eventually love to serve small and growing companies grow in the CFO role.

Full-time CFO

Eventually came quickly. Soon after I came to that conclusion I received a phone call from someone I worked for in high school. He had just started a company that was growing much faster than he could handle. He needed a CFO. I took the position and labored long hours to set up scalable business processes, hire clerical staff, secure financing, and create financial models.

I spent a lot of time on these CFO-level tasks at first, but the initial growth slowed and clerical staff ran the processes with minimal involvement from me. I realized I had worked myself out of a full-time, high-level position. The option of spreading myself out to other companies as a contract CFO never crossed my mind. In hindsight, this may have been a great option. Instead, I left to take another CFO role with another new and fast-growing company.

Full-time CFO (Again)

History repeated itself. I spent a lot of time at first on CFO-level tasks. I cleaned up the books, consolidated the accounting and business processes between divisions, and set up more efficient and scalable processes. I also helped the CEO evaluate the business model, identified the need to evolve, and developed a plan to make the necessary changes.

After a while I realized I had again worked myself out of a full-time job. The business processes had stabilized, clerical staff handled the day-to-day transactions, and the financial crisis had slowed our growth. Again, it didn't make sense for the company to pay a full-time CFO.

Contract CFO

During this time, a business owner I knew was about to lose his controller and was looking for a replacement. As I considered what to do about my CFO role, I had a light-bulb moment. I approached my friend about the idea of replacing his full-time controller with a part-time CFO combined with his clerical staff. He liked the idea, and the arrangement worked out great for both of my employers (now clients).

Benefits of a Contract CFO

After these experiences I took on CFO roles at other companies and continued to see the benefits of a contract CFO for both me and my clients.

The benefits to the contract CFO include: 1. Career development. CFO’s can multiply their experience and contacts by taking on multiple roles at the same time. I was able to work with different management teams in different industries at different company stages, all at the same time. 2. Increased Income. Most small companies can’t pay market rate for a full-time CFO, but most can at least pay the percentage of the market rate that they need a CFO for. 3. Diversification. Many start-ups fail, which gives their executives little job security no matter how valuable they are. If a contract CFO loses one position, they still have their other clients.

The benefits to the client include: 1. Cost. I wasn’t spending more than half my time on CFO-level tasks anyway, so for a little more than half the cost they got the same amount of CFO-level attention. The only difference is they didn’t have as much of my help in other areas, for which they could hire less expensive help. 2. Insight. Working with more than one company gives the contract CFO insights that can benefit the other clients. 3. Flexibility. Clients don’t have the obligation to a full-time employee. As the business needs change over time, they can adjust a contract CFO’s time and pay.

If you are a finance professional, becoming a contract CFO might be a good career option for you. If you are a small company with the need for CFO services without the full-time commitment, a contract CFO is a great solution.

Question: What experiences have you had as a contract CFO or working with a contract CFO?