When running a business, the type of legal entity you choose is a complex and important decision. I recently had to research what type of LLC to set up for a married solo practitioner, or freelancer. I thought I would write about what I have learned to help my thought process and to hopefully help someone else facing a similar decision.

If this post doesn’t apply to you or anyone you advise, you can check out some of my past posts that might be more relevant by using the topic buttons (computer) or menu (mobile device) above.

LLC vs. Sole Proprietorship

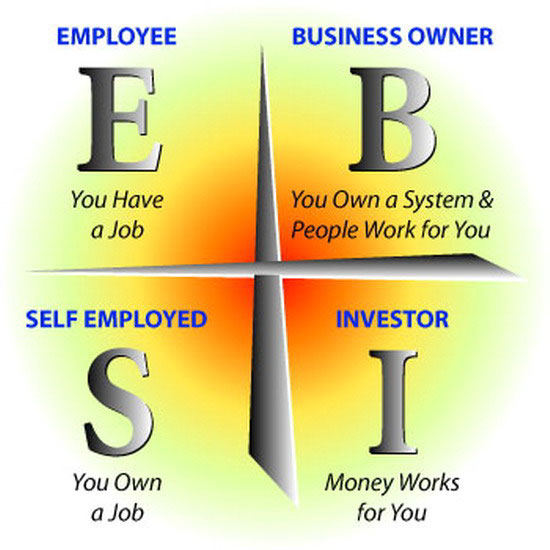

Freelancers who have a full-time job but pick up work on the side will probably start out operating as a sole proprietorship. In fact, you don’t have to do anything but earn extra income to operate as a sole proprietorship. The income becomes part of your business activities, which you report on Schedule C of your personal tax return.

The benefit is that setting it up doesn’t require anything more than any licenses and permits required to operate the business, which probably doesn’t apply to most freelance work.

The down side is there is no legal separation between you and your business, which makes you personally liable for debts, lawsuits, and actions of employees. This puts your personal assets at risk.

An LLC is a legal entity separate from its owners, or members, so the owners aren’t personally liable for the business (with some exceptions). LLC’s are easy and inexpensive to set up and maintain. The filing fee for the LLC I set up in Utah was $70. The only maintenance needs are tax and regulatory requirements, which you’d have to do for a sole proprietorship anyway, and a $15 annual renewal fee.

If your business is anything more than small side jobs here and there, it is usually wise to set up an LLC. Search online for “how to set up an LLC in [your state]” and you’ll find many resources with step-by-step instructions. For example, see here for Utah instructions.

Types of LLCs

Once you’ve decided to set up an LLC, you’ll have to decide how it’s structured for tax purposes. There are several variations, and each state may differ slightly, but the following are 3 types of LLCs I considered:

1. Single-member LLC (Disregarded entity) As indicated by the name, a single-member LLC is owned by one person. The owner can either file Form 1040 Schedule C like a sole proprietor (become a disregarded entity) or elect to be taxed as a corporation.

There are some disadvantages when compared to a multi-member LLC, including: - Some risk of losing the LLC personal liability protection benefit in the event of a lawsuit or audit. Courts may not recognize the person as being separate from the entity. - Possible increased risk of an IRS audit because sole proprietorships are audited more frequently than partnerships or corporations.

This article talks about these and other disadvantages.

One advantage of a single-member LLC is that it qualifies for a Health Reimbursement Arrangement (HRA) if one spouse is the owner and the other spouse is an employee. This is a program administered by a 3rd party that allows your LLC to reimburse 100% of out-of-pocket health expenses and individual health insurance premiums. The HRA is the only way I’m aware of to make individual health insurance premiums fully tax deductible. Multi-member LLC’s do not quality for an HRA.

You can read more about HRAs here.

2. Multi-member LLC (Partnership) Multi-member LLCs, obviously, are owned by more than one person and can be elected to be taxed like a partnership or a corporation. As a partnership, the LLC must file Form 1065 and provide each member with a Schedule K-1 showing their share of the LLC income, credits and deductions.

A multi-member LLC overcomes the disadvantages of a single-member LLC described above. Married couples can create a multi-member LLC by each owning a share of the company.

LLC members active in the business must pay self-employment tax on their entire share of the profits. Married couples are always both considered active members, even if one is not active in the business. The maximum earnings limit ($118,500 in 2014) applies to each spouse. If the profits are more than the maximum, and if you want to minimize this tax, you might want to assign one spouse a very small percentage.

This article goes into detail about single-member vs. multi-member LLC’s for married people.

3. LLC as an S-Corp An LLC can elected to be treated like an S Corp. This is an interesting way to minimize self-employment tax. The members don’t have to pay self-employment tax on their share of the profits, but active members (again, both spouses) must be paid reasonable compensation subject to self-employment tax.

This article talks about electing S Corp status, and here is an IRS publication that describes “reasonable” compensation.

Summary

There is much more to choosing a business entity than I have covered here, but hopefully my research on LLC’s helps familiarize yourself with the options available. Understanding the basics will allow you feel more confident in working with a professional advisor to make a final decision.

Note: I am not an attorney, and although I’m a CPA, I am not a tax accountant, so don’t take this as professional advice. I have provided this material for informational purposes only, and I encourage you to seek competent tax and legal counsel.